- Foodservice Octopus

- Posts

- Consumer Packaged Goods (CPG) Industry Overview: 2024 & 2025

Consumer Packaged Goods (CPG) Industry Overview: 2024 & 2025

Whats Going on in the CPG World?

Consumer Packaged Goods (CPG) Industry Overview: 2024 & 2025

The consumer packaged goods (CPG) sector is extremely sensitive to consumer demands and perceptions.

For many years, that meant the space was dominated by billion-dollar companies (like Procter & Gamble). But in recent years, smaller direct-to-consumer CPG brands have been gaining momentum.

The CPG sector is also in the midst of a digital transformation that is radically changing how consumers shop and how brands advertise their products.

In this report, you’ll get a comprehensive overview of the CPG market that highlights the fundamental characteristics of the space as well as the key players and market trends of today.

What Are Consumer Packaged Goods?

Consumer packaged goods (often shortened to “CPG”) are products that consumers use frequently and eventually need to replenish or replace. Common CPG product categories include food, drinks, cleaning supplies, and makeup.

CPG Industry: Fast Facts

The global CPG industry is predicted to add $3.18 trillion in value in 2024.

In the United States, that amounts to $821 billion of value added.

The industry value is projected to reach $18.94 trillion by 2031, a CAGR of 5.1% from 2022 to 2031.

Top segments in the CPG space include food and beverage, cosmetics and personal care, household supplies, pet care, and OTC medicine and healthcare.

67 of the top 100 CPG companies are in the food and beverage category.

Compared to 2021, the average American household now makes 10+ more trips per year to buy food and beverages.

Approximately $1.4 trillion is spent on food each month.

Each American spends an average of $722 per year on their personal appearance. That includes hair products, skin products, and makeup.

More than two-thirds of consumers are increasingly insistent that the CPG industry become more responsible in terms of sustainability, corporate responsibility, and consumer privacy.

CPG companies spend about 23% of their total budgets on advertising and marketing.

29% of all CPG ad dollars were spent in the food segment. Non-alcoholic beverages took 9% of ad spend.

Procter & Gamble, valued at a total of $364 billion, owns some of the most valuable CPG brands today like Pampers, Gillette, Crest, and Charmin.

The conglomerate raised prices 10% in the first quarter of 2023 and as a result, recorded a 4% growth in revenue year-over-year.

With a market value of $259.2 billion, L'Oréal is the clear leader in the cosmetics market.

The cosmetics and beauty market was the fastest-growing retail sector in 2023.

In one example, e.l.f. Beauty’s revenues were up 76% year-over-year in the second quarter of fiscal year 2024.

Six in ten CPG executives say developing or expanding their direct-to-consumer (DTC) channels is a key priority.

In March 2023, DTC ecommerce sales were up 12.9% year over year.

Solo Brands, the DTC company that owns Solo Stoves, Oru Kayak, and Chubbies, started their brand in 2016 with a Kickstarter campaign. Fast forward to 2024: the company is pulling in more than $500 million in annual revenue.

The DTC pet food market is predicted to swell to $18.6 billion by 2032, a CAGR of more than 25%.

CPG Market Overview

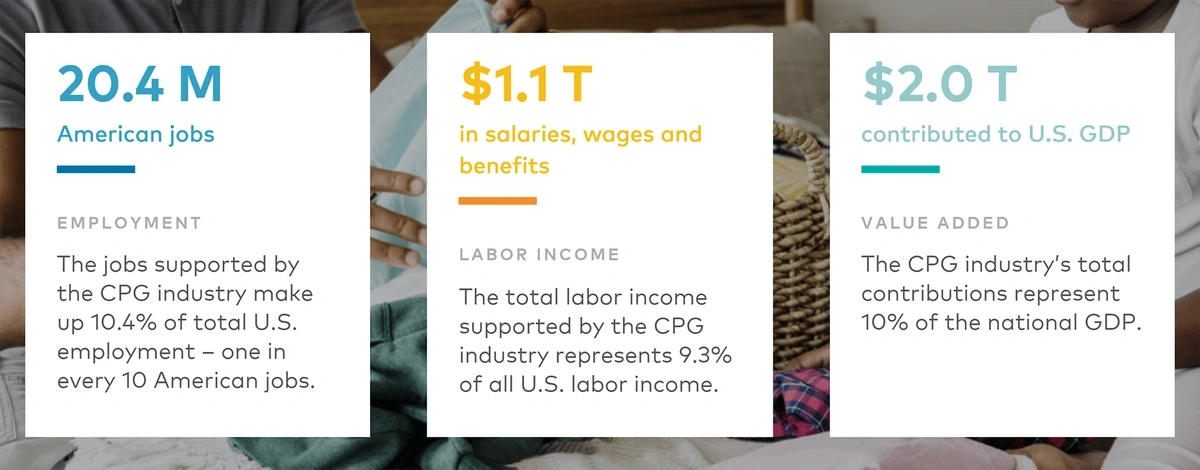

In total, the U.S. CPG market makes up 10% of the national GDP.

The CPG industry supplies millions of jobs and trillions of dollars in economic impact.

The two largest segments of the CPG market are food and beverages (30% market share) and personal care/cosmetics (20% market share).

The brands that dominate the CPG market are billion-dollar brands that nearly every American knows: Nestle, Procter & Gamble, Pepsi, Tyson, and L’Oreal just to name a few.

But small DTC brands have been pulling customers away from the CPG giants during the past few years.

Coterie is a DTC startup that’s focused on non-toxic diapers.

Advertising is where the competition between brands gets very heated.

In fact, the CPG industry spends more on advertising than any other sector in the United States.

The food and beverage subcategory leads all spenders with $1.94 billion in advertising costs each year.

Advertising for snacks and desserts alone is responsible for one-quarter of all CPG advertising spend.

Kellogg’s, the parent company of Pringles, spends approximately $392 million on ads per year.

The beauty segment is another ultra-competitive sector of the CPG market.

For example, Unilever spends nearly $300 million on advertisements for Dove.

In 2024, the brand partnered with Nike for its first Super Bowl ad in several years.

Dove has most notably had success with social media advertising.

For example, the brand ran several ads on Meta platforms in the summer of 2023.

But the ads weren’t focused on Dove products. Instead, the ads focused on Dove’s brand identity and promoted the Kids Online Safety Act.

Dove’s social media ads urged users to support the Kids Online Safety Act.

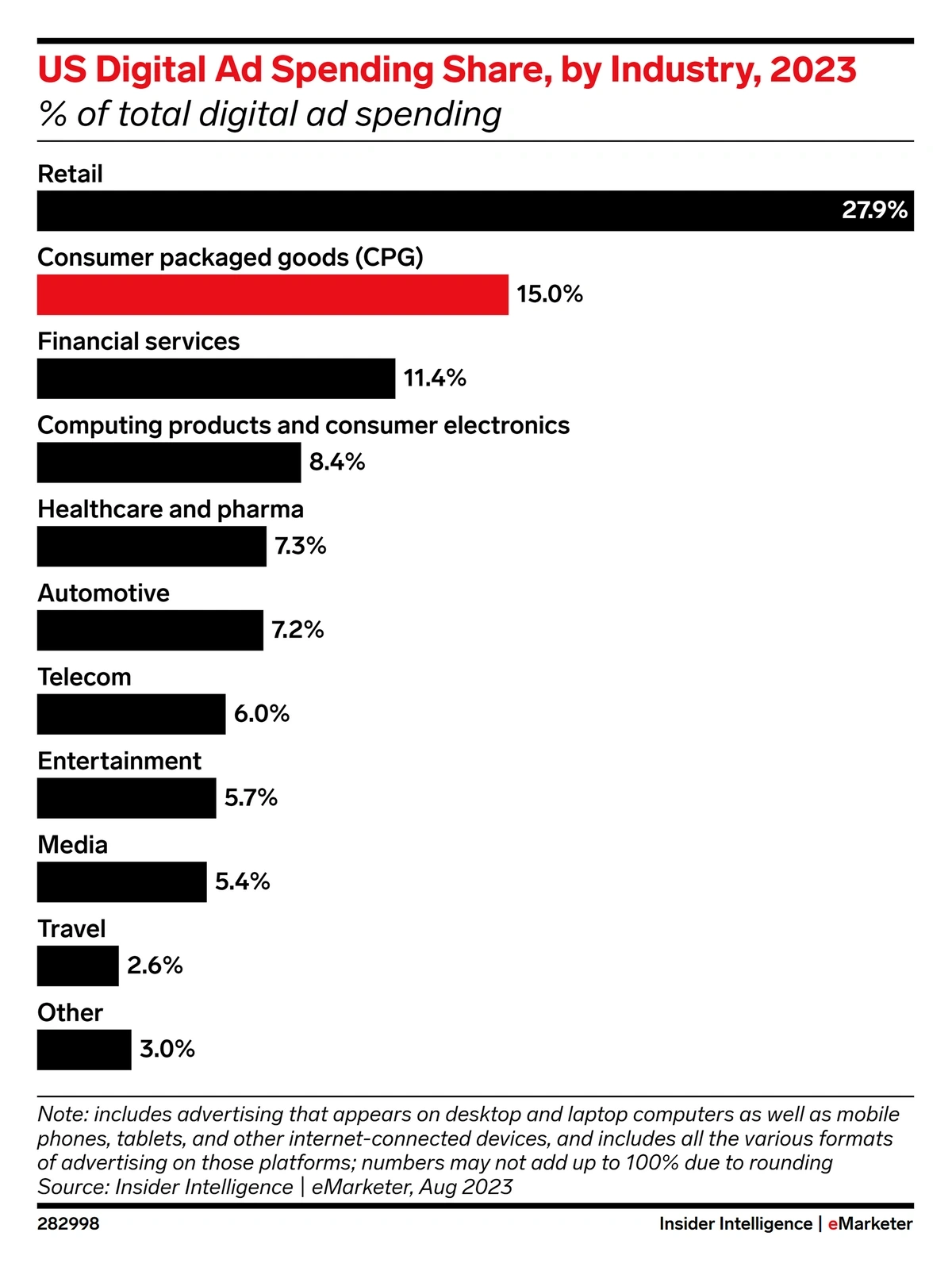

In particular, as the number of shoppers buying online grows, the amount that CPG brands spend on digital advertising has been growing.

CPG brands spent about $39.50 billion on digital ads in 2023 and experts say this number could grow by 12.9% in 2024.

CPG brands hold 15% of total digital ad spending.

Notable CPG Product Categories For 2024-25

Food and Beverage

The food and beverage segment drives the highest sales in the CPG market.

In December 2023, monthly food sales in the United States topped $1.46 trillion. That’s up from $1 trillion in May 2019.

And, nearly 20% of Americans say they’ll spend more on groceries in 2024.

Consumers say they’ll be increasing their grocery budgets in 2024.

In particular, sales of plant-based foods are surging.

Overall, the plant-based food market was valued at $11.3 billion in 2023 and is predicted to continue growing at a CAGR of 12.2% through the next decade.

A 12-week survey from Kroger showed that more than 1.4 million households engaged with plant-based products on the Kroger ecommerce platform.

As for purchases, Kroger reports that nearly 40% of shoppers are choosing plant-based milk, 25% are choosing plant-based meats, and 22% are choosing plant-based yogurt.

The Plant Based Food Association echoes this data. They say 40.6% of all American households purchased plant-based milk in 2023.

NotCo is one plant-based company that’s seen great success with its “NotMilk” product line.

Search interest in “NotCo” is up nearly 500% over five years ago.

Although the brand began offering its non-dairy milk in the chilled case, they have recently switched strategies and are moving to the shelf-stable milk space.

In early 2024, they expanded their lineup to include two more NotMilk varieties—unsweetened vanilla and a barista blend that’s optimized for use with coffee.

NotMilk comes in a variety of flavors.

NotMilk is currently sold in more than 3,500 stores across the U.S.

Pet Care

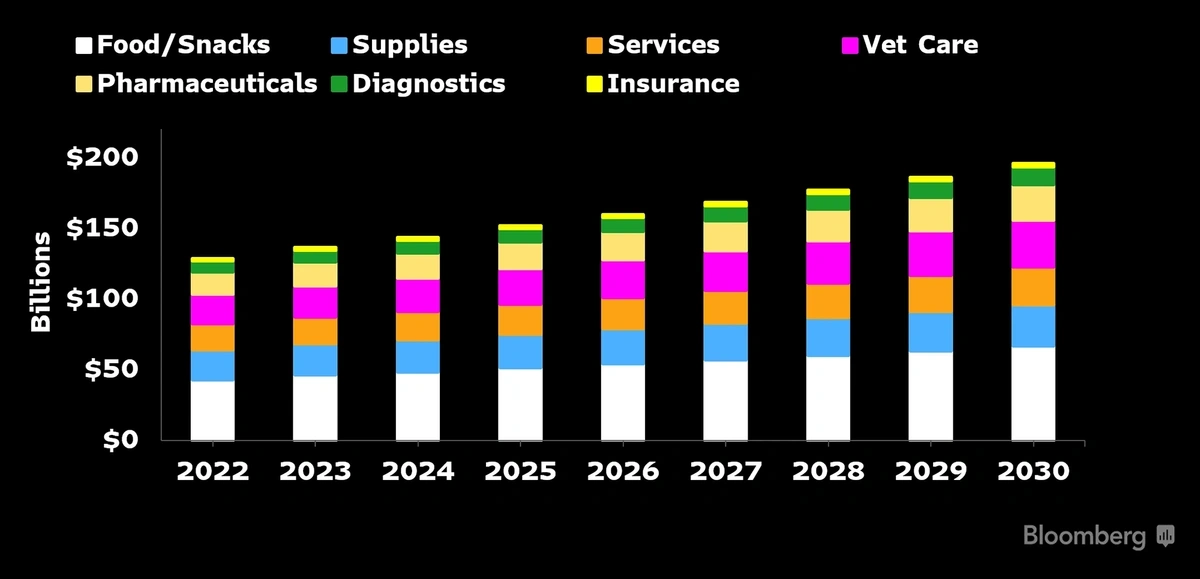

According to Bloomberg Intelligence, the pet care industry was valued at $320 billion in 2023 and could grow to nearly $500 billion by 2030.

The pet care market is predicted to grow into a $500-billion business by 2030.

Bloomberg points to two main factors influencing this growth: rising pet ownership and the premiumization of pet food and services.

In the U.S., two-thirds of all households own at least one pet. That’s an 18% jump from 1988.

That amounts to roughly 85 million dogs and 65 million cats.

Pet owners aren’t holding back when it comes to spending money on their pets.

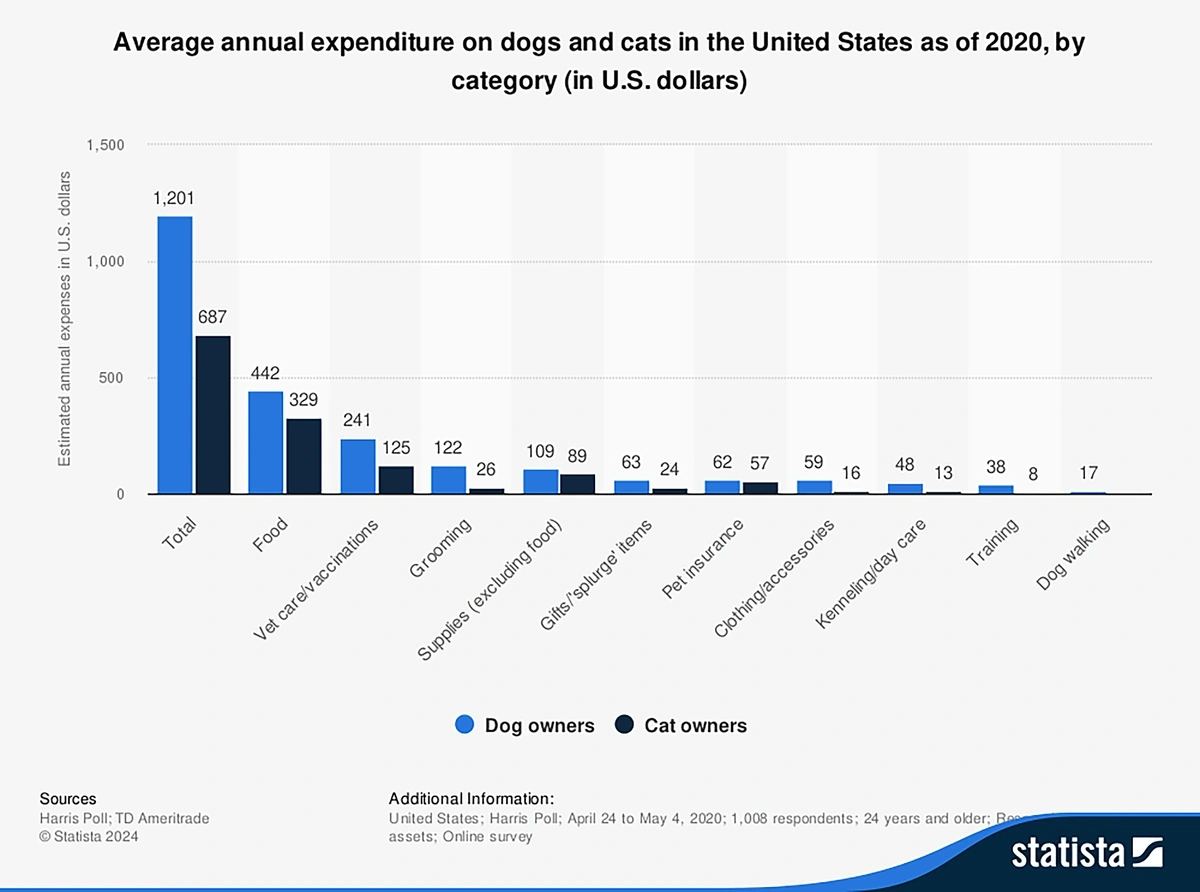

On average, dog owners spend $442 on pet food per year.

In total, they spend $1,201 on their dogs per year.

Dog owners spend more than $1,200 annually on their pets.

Bloomberg’s stats predict the overall pet food market will surge ahead 52% in the next five years to land at a value of $135 billion.

That’s compared to just $59 billion in 2010.

One survey revealed that more than a third of pet owners plan to increase their spending on pet food in the next six months.

Much of the growth in the pet food market is on account of premium dog food brands.

Sundays for Dogs is a pet food brand that’s exploding right now.

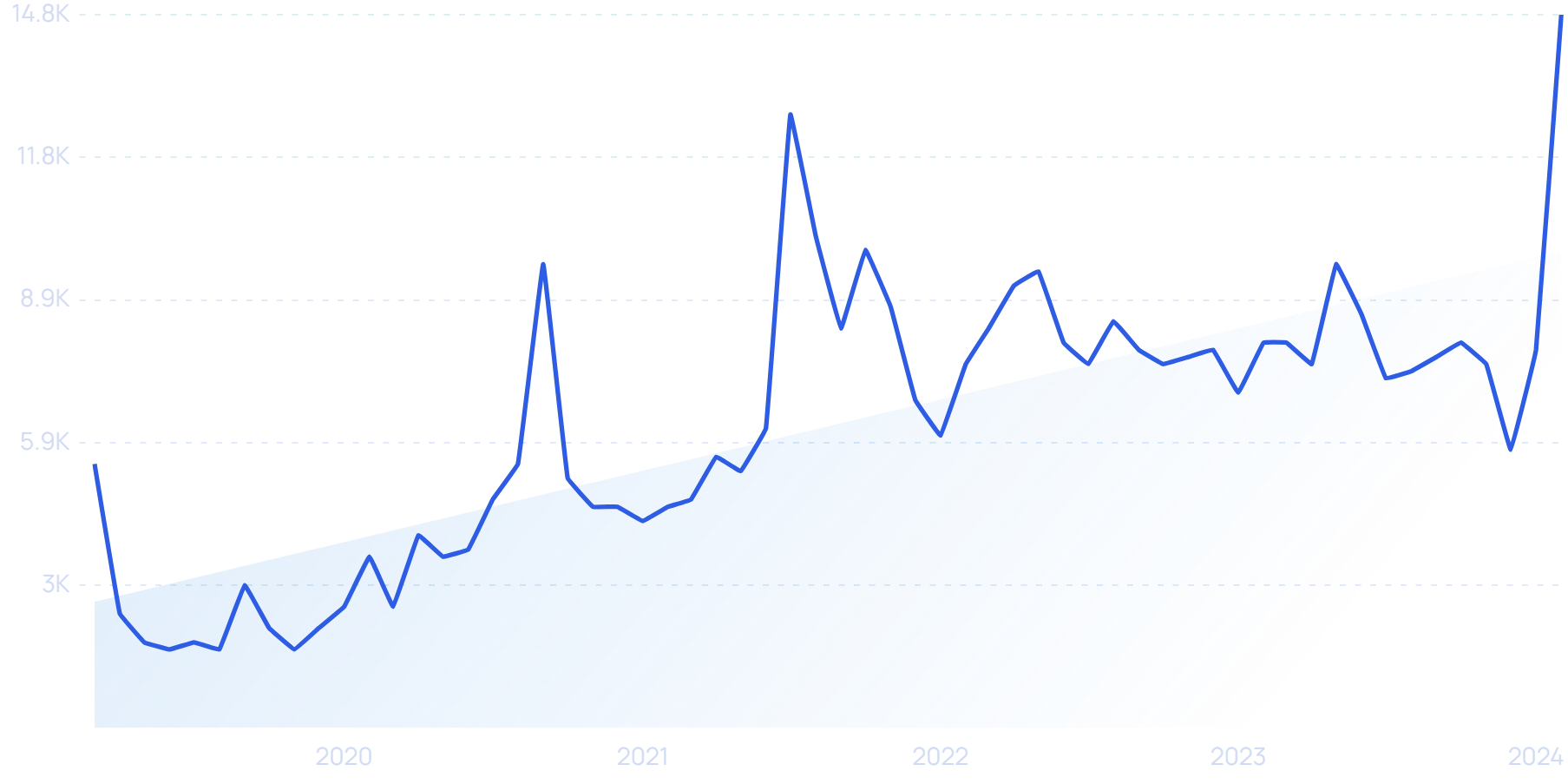

Search interest in “Sundays for Dogs” has increased more than 3,000% in recent years.

The company offers air-dried, human-grade dog food.

Consumers can choose from beef, turkey, or chicken recipes.

There’s also growing consumer demand for pet-related products aimed at longevity.

Take Wuffes, for example.

Search interest in “Wuffes” has grown nearly 9,000% in the past five years.

The pet company produces supplements aimed at improving hip and joint health in dogs.

Health and Wellness

Another category of CPG products that’s showing rapid growth is the wellness market, which is predicted to bloom into a $7 trillion space in just a few years.

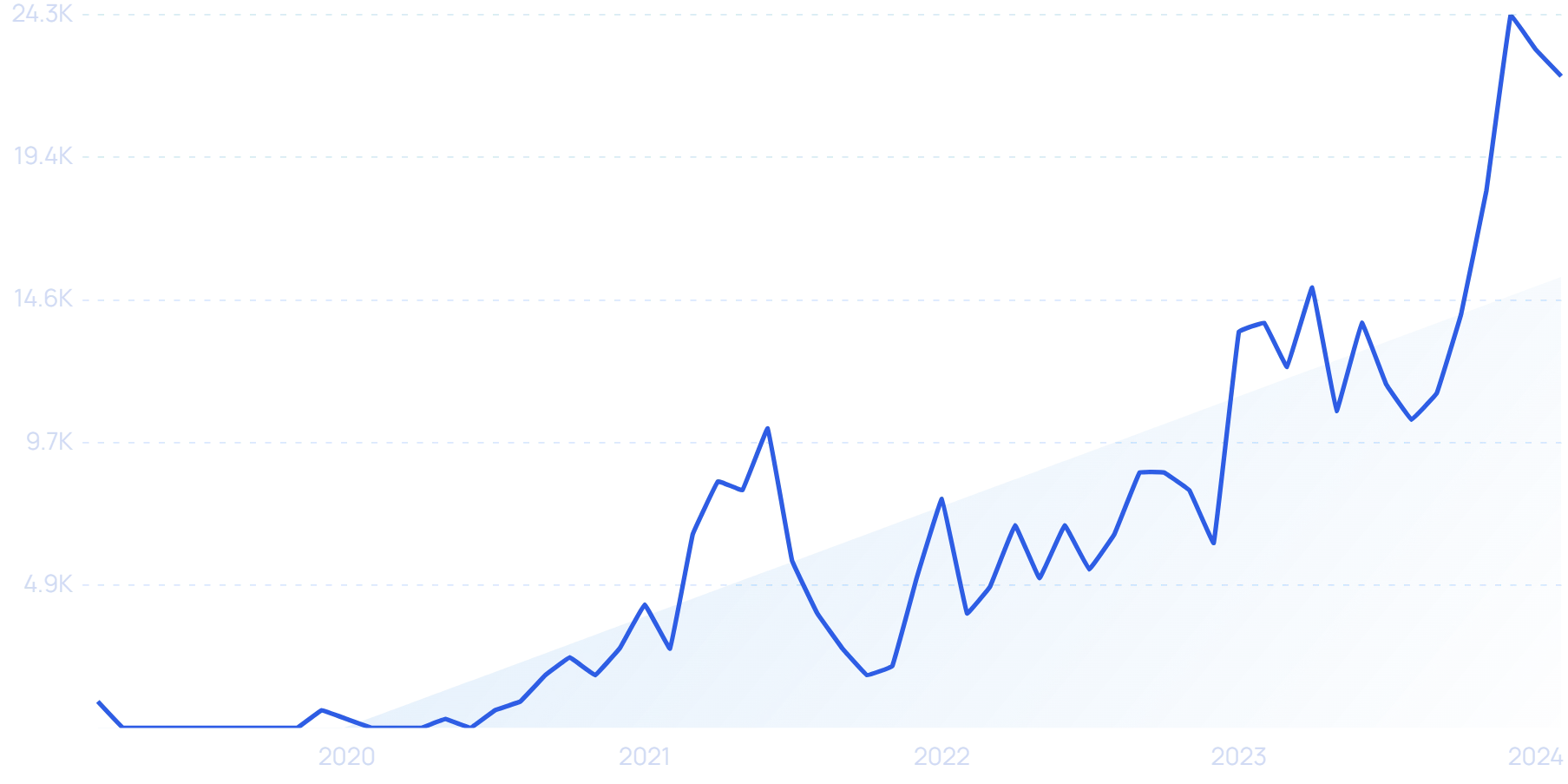

McKinsey reports the top two areas of consumer spending in this sector are appearance and health.

The appearance category includes purchases like hair care and skin care products while the health category includes products like OTC medicine and at-home healthcare products.

More than 40% of Americans have made a purchase related to their appearance in the past 12 months.

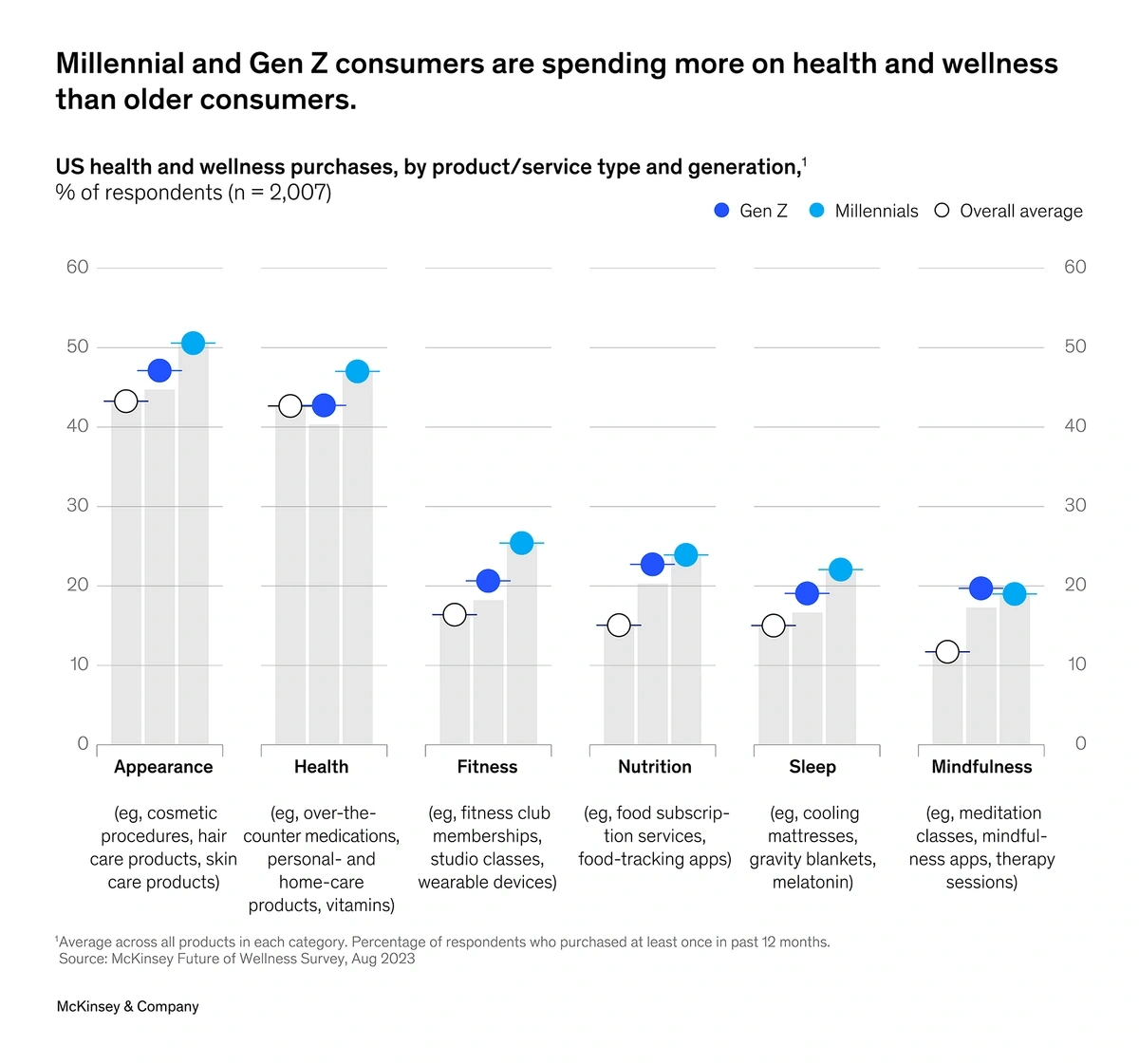

Their research also shows that consumers are favoring clinically proven ingredients in these types of products.

When it comes to “consumer goods,” nearly half of respondents prefer products that are clinically proven.

This trend is being seen in foods and supplements aimed at improving gut health.

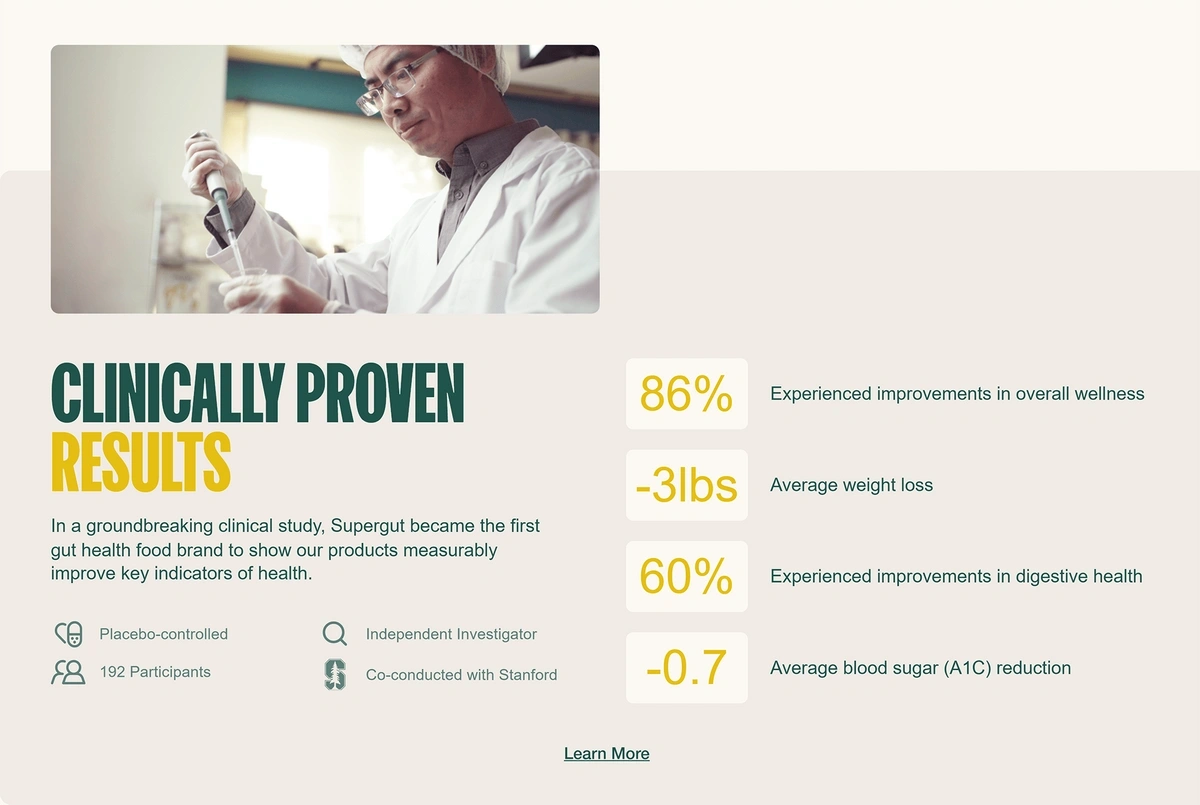

Supergut is one example.

Search interest in “Supergut” jumped in 2023.

The brand offers prebiotic mixes that are clinically proven to improve gut wellness and help users lose weight.

Supergut partnered with Stanford while conducting their clinical study.

The brand began as a DTC company but has recently launched on Amazon and in stores like Sprouts, Erewhon, and Bristol Farms.

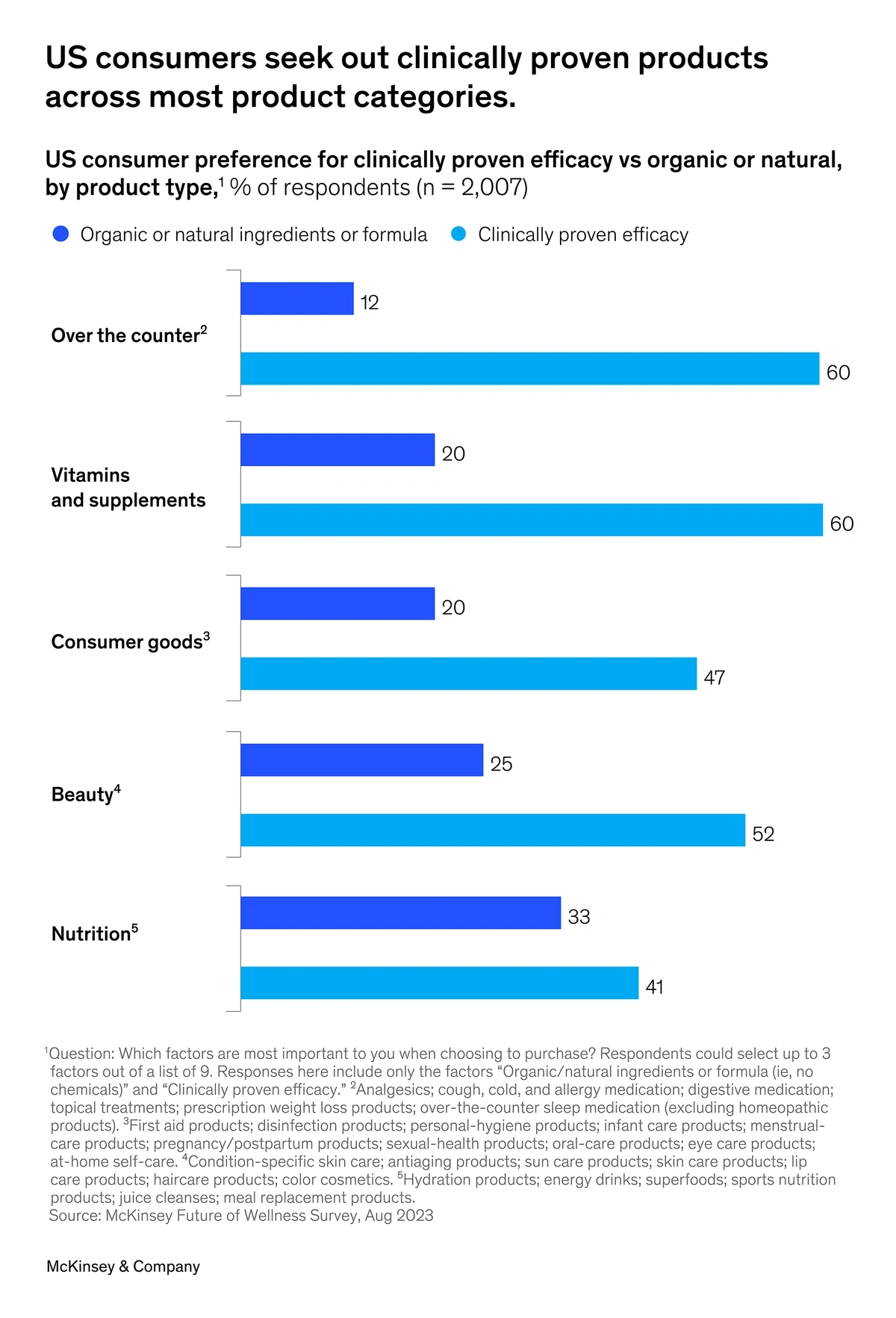

Consumer demand for clinically-proven sleep supplements is climbing, as well.

The sleep supplement sector grew nearly 15% in both 2021 and 2022.

In particular, sales of children’s sleep supplements are increasing.

A recent study showed that 1 in 5 kids and teens are using sleep supplements on a regular basis.

Hiya is a startup offering supplements specifically for kids.

Search interest in “Hiya vitamins” has grown exponentially since 2022.

A sleep supplement called Kids Bedtime Essentials is one of their products.

It contains a blend of vitamins and extracts designed to help children calm down at bedtime.

Notable CPG Brands For 2024-25

Bobbie

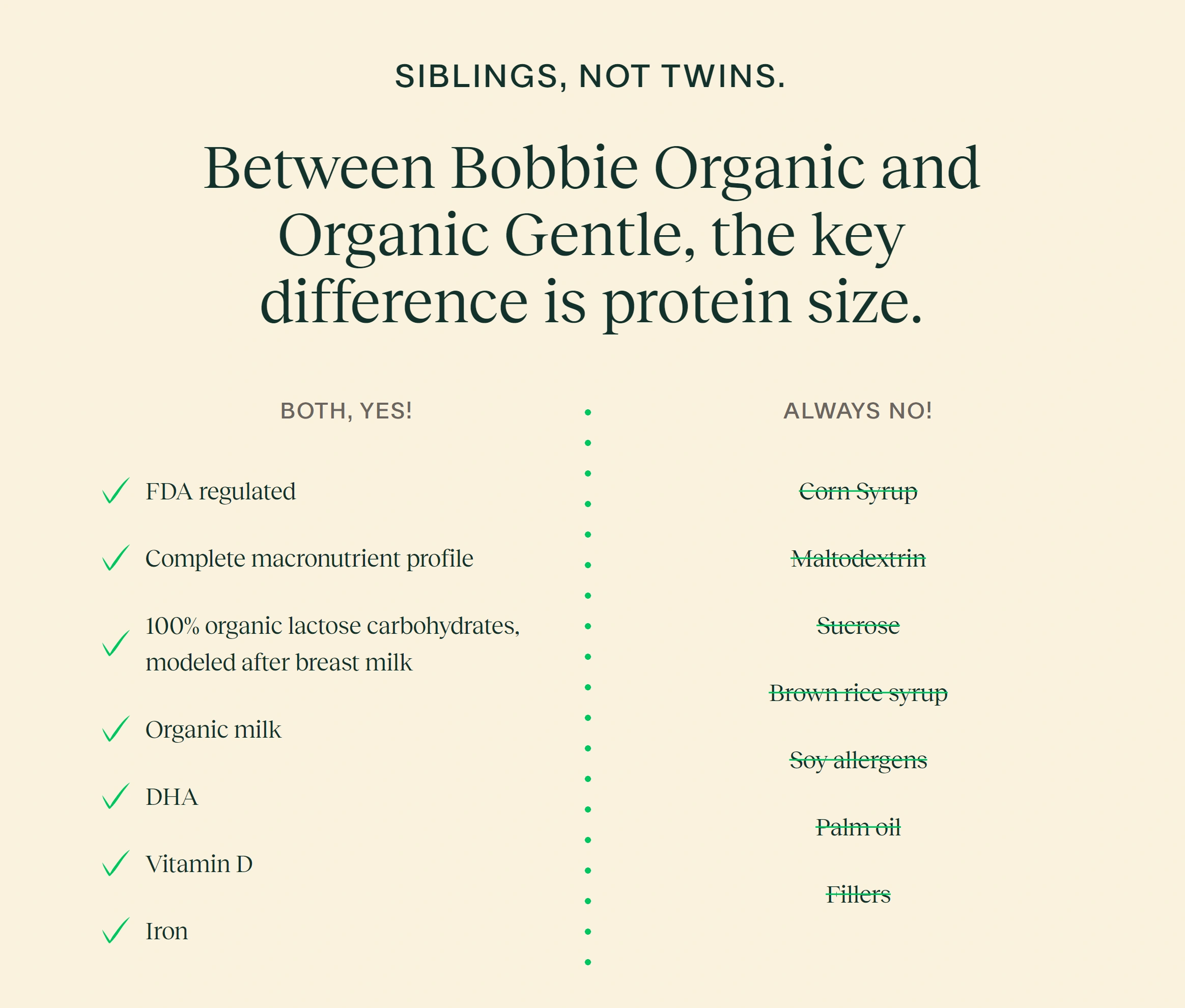

Bobbie produces organic baby formula.

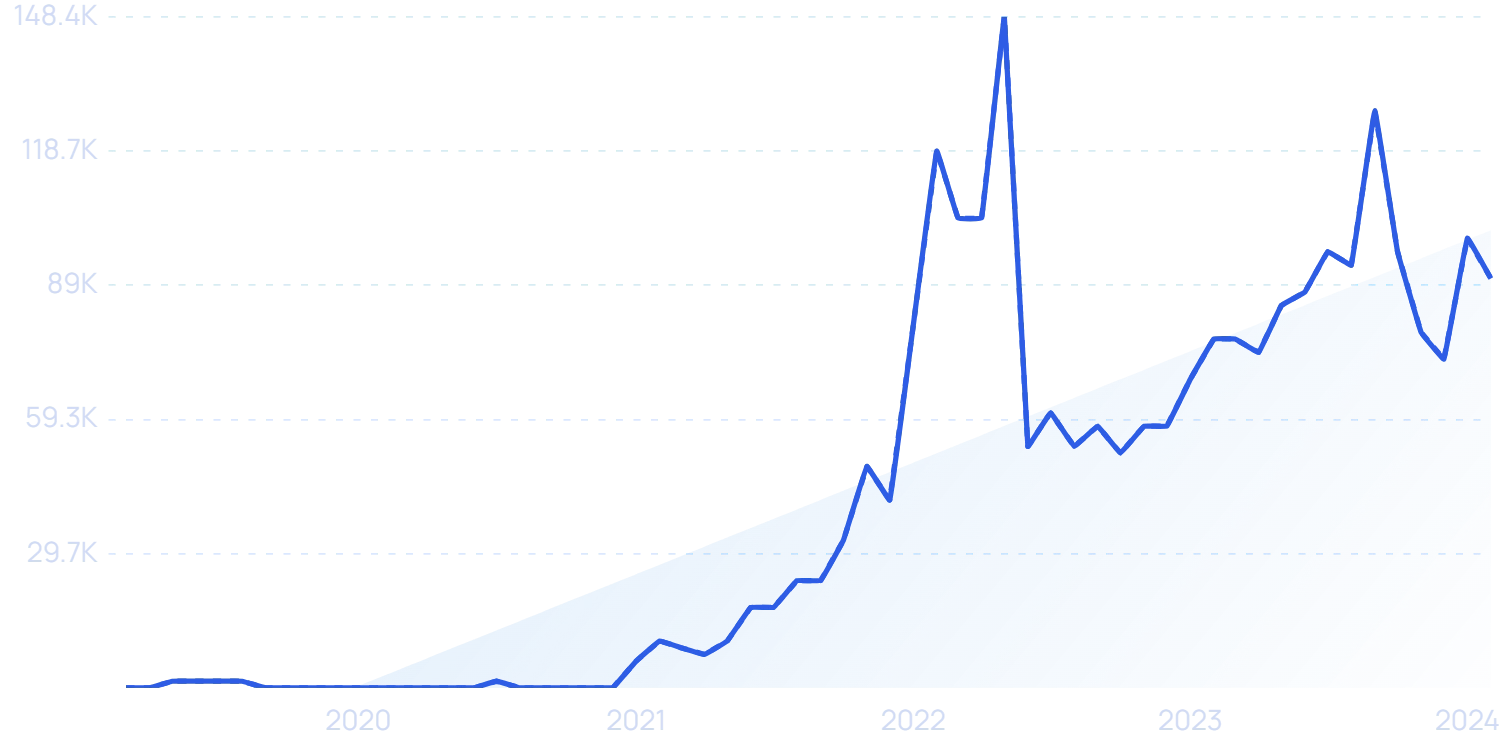

Search interest in “Bobbie formula” increased during the recent baby formula shortage and steadily increased again throughout 2023.

Founded in 2019, the company takes a unique route in producing the formula. Its main ingredient is milk from grass-fed cows.

Bobbie’s formula appeals to parents looking for a more natural way to feed their infants.

In mid-2023, the company acquired a separate pediatric nutrition company and thereby tripled its operating capacity.

In addition, the company grew nearly 400% in 2022 and surpassed $100 million in revenue.

In all, Bobbie supplies formula to 5% of the non-WIC market.

OLIPOP

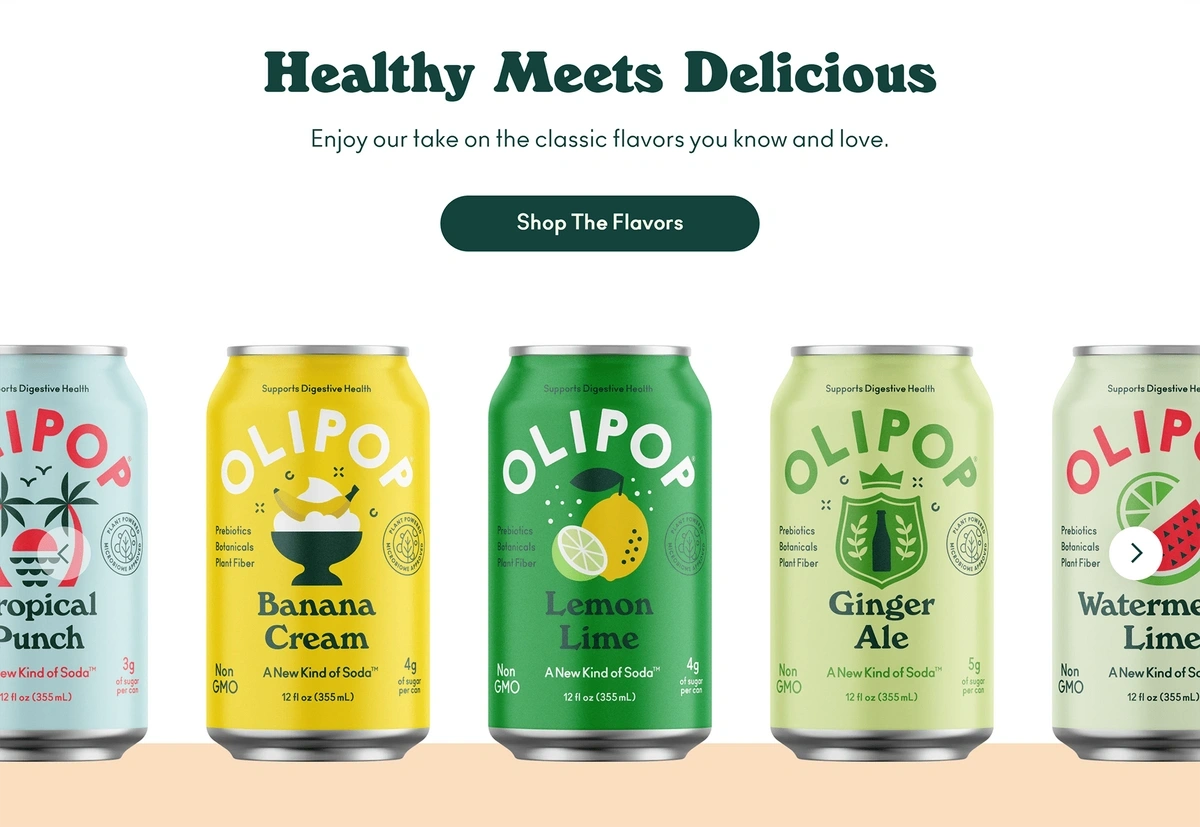

OLIPOP is a good-for-you sparkling soda.

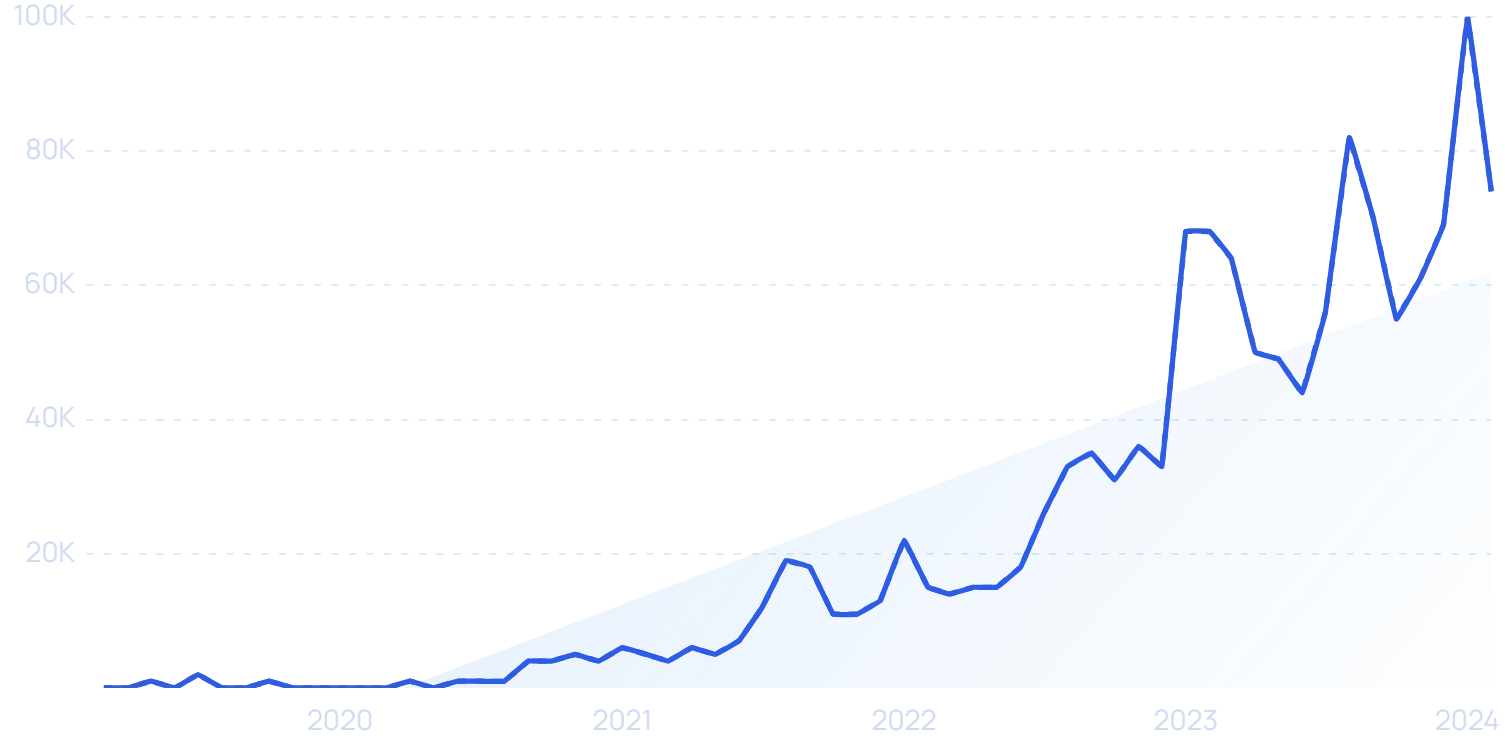

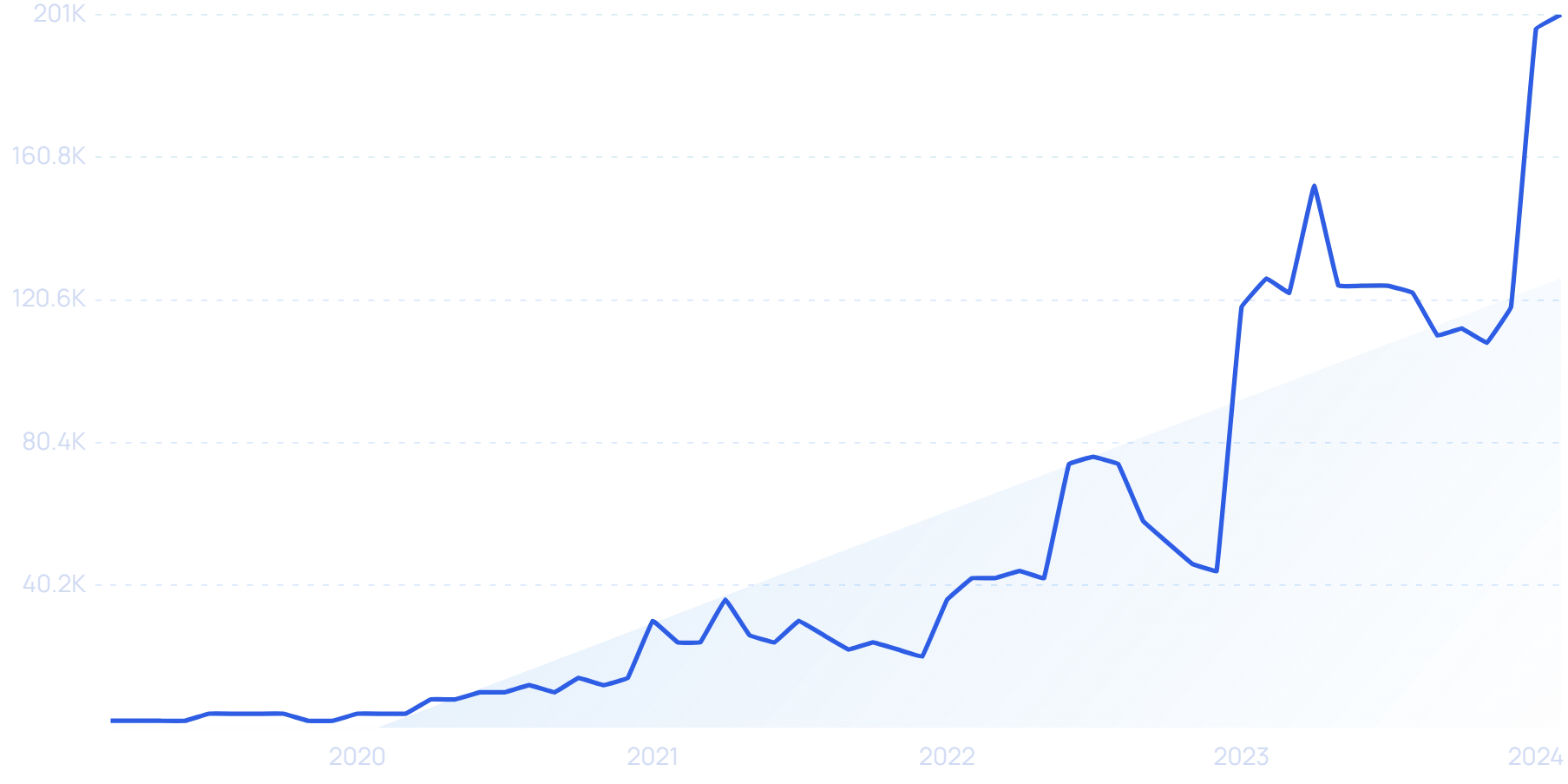

Search interest in “OLIPOP” has increased rapidly in recent years.

Each can of OLIPOP has 9 grams of fiber and no more than 5 grams of sugar.

OLIPOP sells several flavors of soda.

The brand also markets itself as “gut healthy” because the soda contains a blend of plant fibers, prebiotics, and botanicals.

In 2023, OLIPOP was the second-fastest growing brand on Instacart.

The company brought in about $200 million in revenue that same year.

Chomps

Chomps, a meat stick brand, also ranked on Instacart’s list of fastest-growing brands in 2023. The company came in at number five.

The fastest-growing brands on Instacart in 2023 were led by MUSH, OLIPOP, and ZOA Energy Drinks.

This family-owned business utilizes sustainably produced beef, domestically produced turkey, and grass-fed venison to produce their products.

Chomps’ jerky sticks are now sold in more than 20,000 retail locations.

And, the brand is still growing.

In 2022, Chomps secured its first private equity investment—$80 million from Stride Consumer Partners.

More CPG Trends For 2024-25

Continued Growth for Private CPG Labels

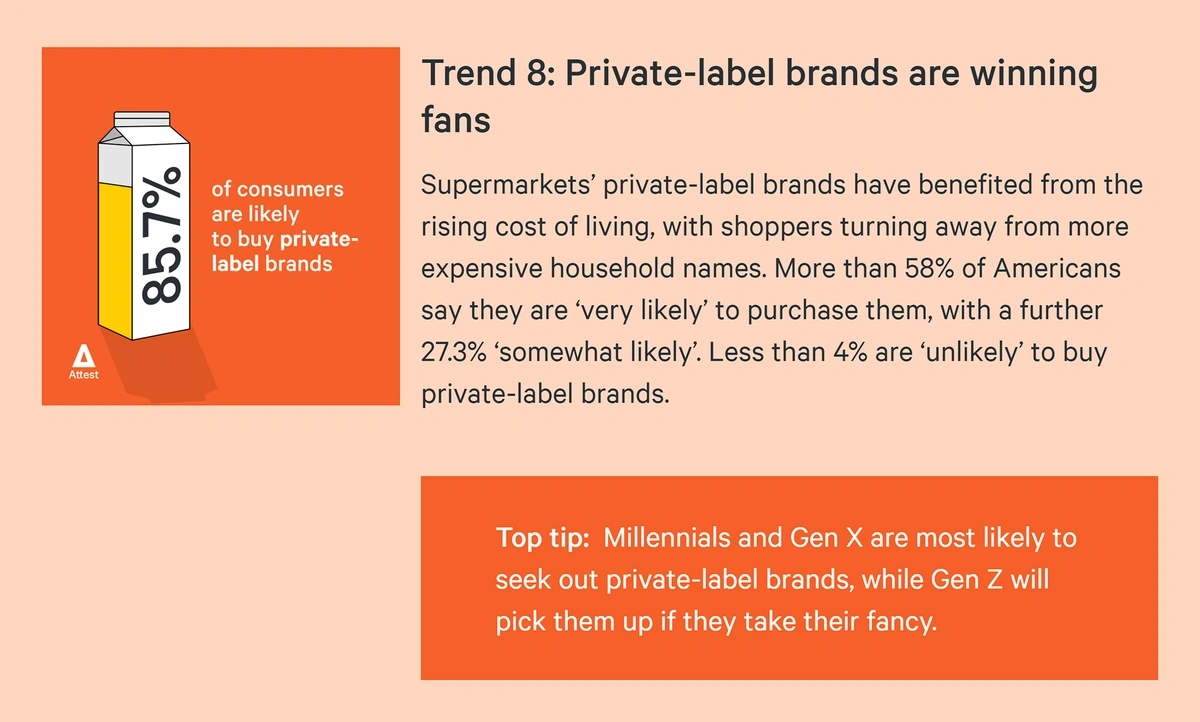

The pandemic prompted many consumers to change their shopping behavior and some of these new habits have stuck.

Buying store brands (also called “private labels”) has taken root in the lives of consumers.

41% of consumers say they’ve purchased more private-label products since 2020.

With surging inflation in 2023, it’s no surprise that price and value are their main reasons for purchasing these items.

However, one survey reported more than 85% of shoppers plan to continue buying store brands even after inflation cools.

Only 9% say they’ll go back to national brands.

More than 85% of consumers say they’re likely to buy private-label products.

The Private Label Manufacturers Association reported that store brands brought in $23.2 billion in 2022, a new record.

Overall, that means store brands have posted a nearly 40% growth over the past five years.

Dollar sales of private-label products increased more than 8% in the first half of 2023, and these products now account for 19% (dollar value) of CPG sales.

Several major retailers have shown dedication to pursuing this trend.

At Aldi, Lidl, and Costco, private-label brands are responsible for more than 50% of the total SKU count.

Kroger’s “Smart Way” is the fastest-growing private label.

The Smart Way brand offers staples at an affordable price.

Household penetration of the brand was up 4.5 points between 2022 and 2023.

The brand features 150 SKUs of food and household items.

Overall, Kroger’s private brands grew nearly 5% in the first quarter of 2023.

Multiple Segments Offer Healthy Aging and Longevity Products

McKinsey reports that there’s growing demand for CPG products aimed at increasing longevity and improving the aging process.

Their surveys showed more than 60% of consumers say it’s very or extremely important to purchase products that will contribute to healthy aging and a longer life.

And, 70% of consumers say they’ve purchased more products aimed at improving the aging process this year compared to previous years.

Statistics show the median age of the American population has grown to about 40 years old.

And, the number of Americans 65 and older will jump 47% by 2050.

Market experts say this jump in age will likely drive even more demand for products related to healthy aging.

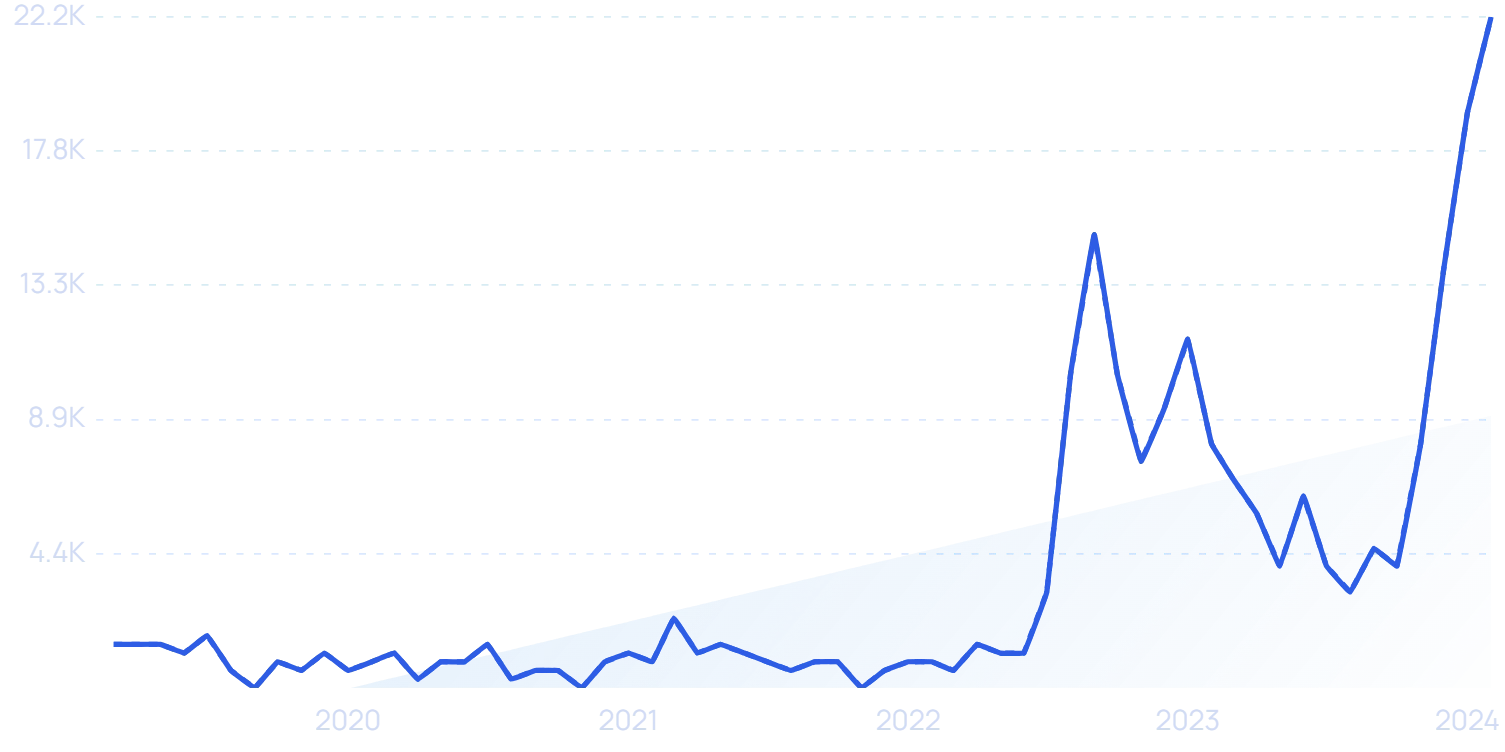

One specific area that’s seeing increased attention is menopause care.

The total value of this space could hit $24.4 billion by 2030.

A large portion of that value is based in the menopause supplement market.

Bonafide Health offers four specialized supplements aimed at improving menopause symptoms.

Search volume for “Bonafide Health” has increased by more than 1,000% since 2020.

The brand was acquired by Pharmavite (best known for the NatureMade brand) in late 2023 for $425 million.

Another growing area of the healthy aging sector is products aimed at older adults.

People over age 50 buy 54% of all groceries in the United States.

These consumers are looking for nutritious food to cook at home—nearly 90% say they pay attention to nutrition and 81% frequently cook at home.

Foods and supplements with cognitive-boosting ingredients like omega 3s, amino acids, and polyphenols are also becoming more popular.

In addition, older adults are looking for products that will help them manage health issues that come with aging.

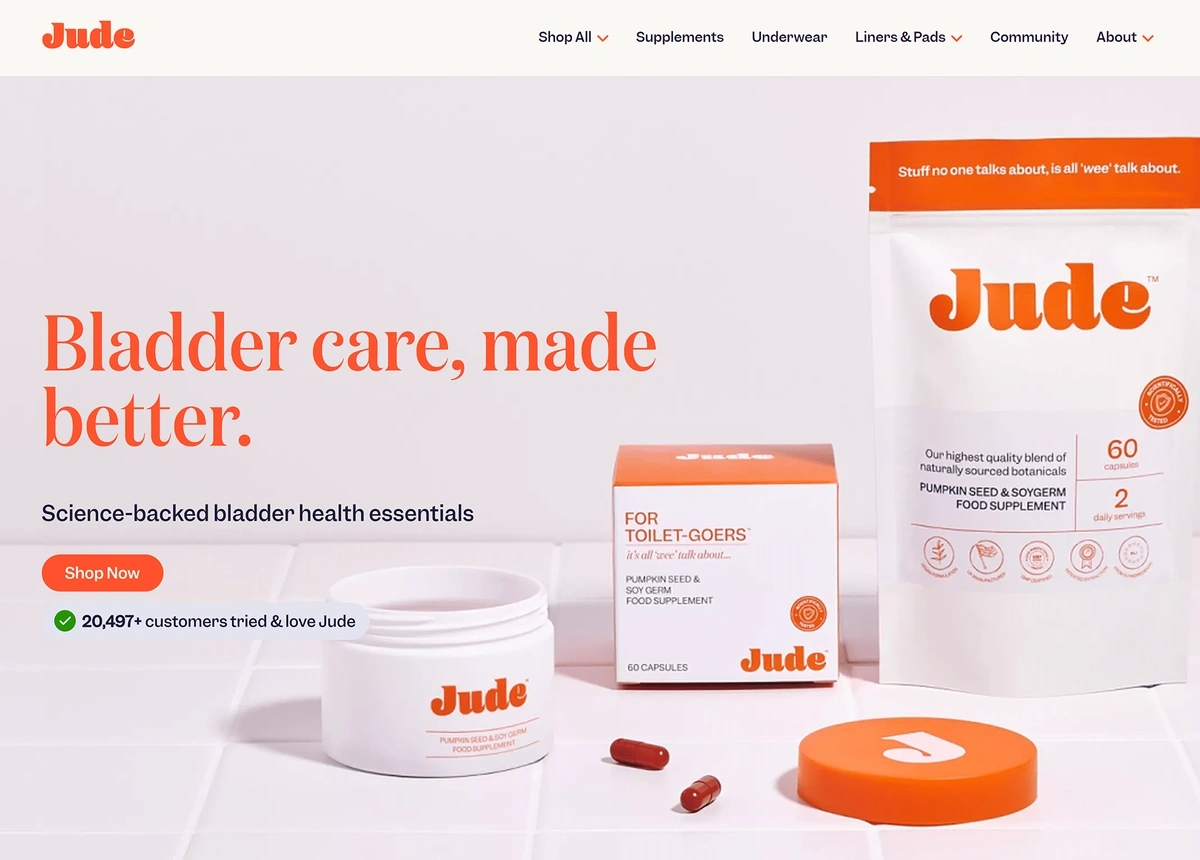

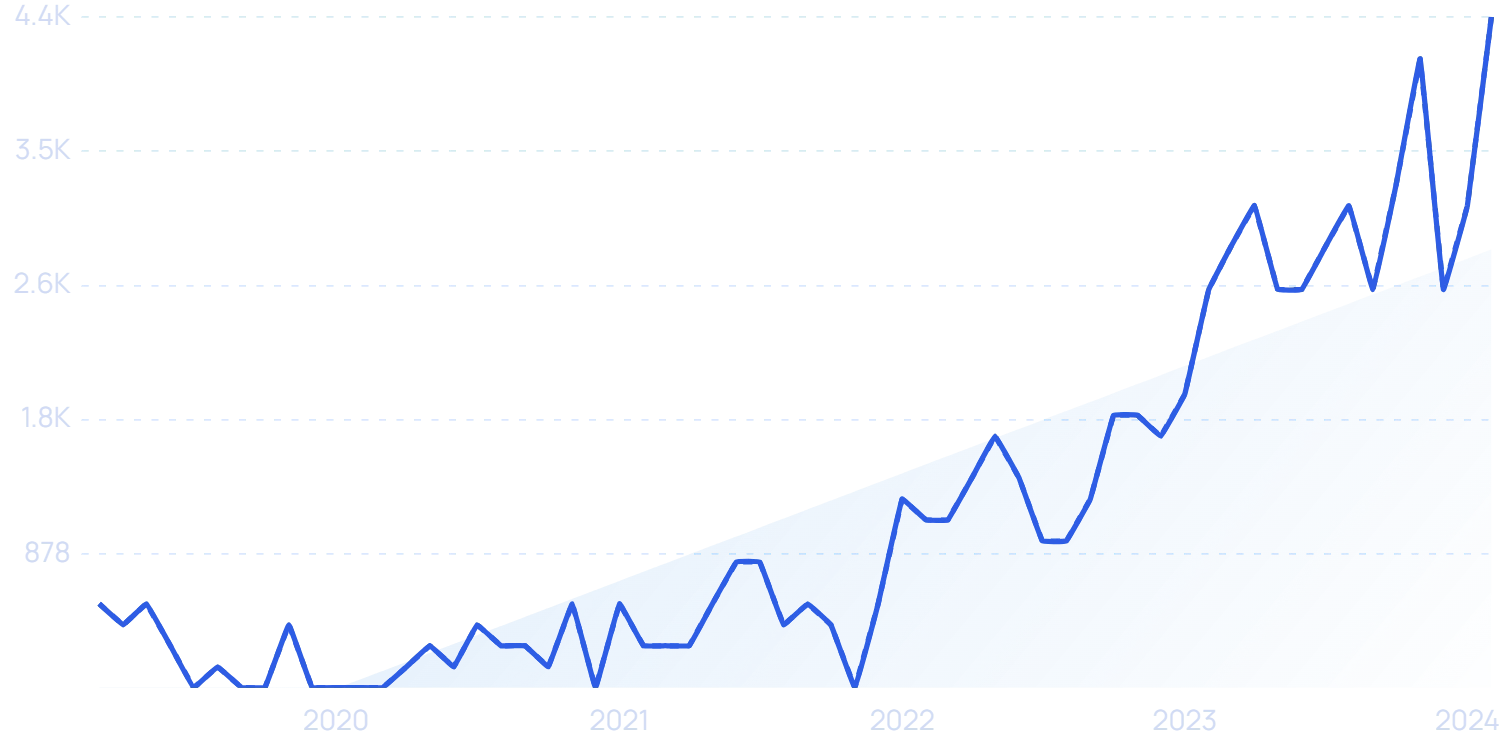

For example, Jude is a DTC healthcare company that specializes in bladder care.

Jude’s products are backed by scientific research.

The brand sells supplements, absorbent underwear, and pads that address bladder concerns.

In the company’s first 18 months, revenue grew 700% and its customer base grew 8x.

Growing Reliance on Retail Media Advertising

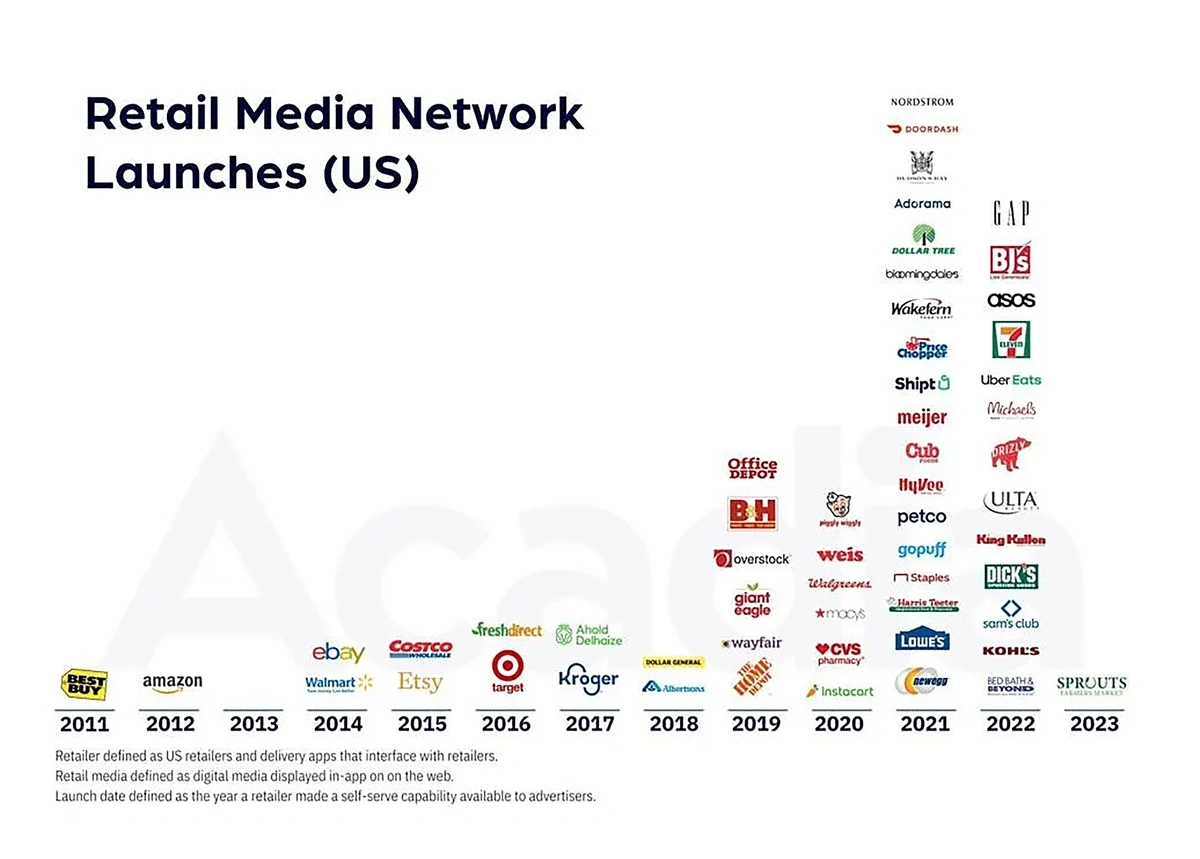

Retail media networks typically refer to advertising that appears on retailer-owned e-commerce sites.

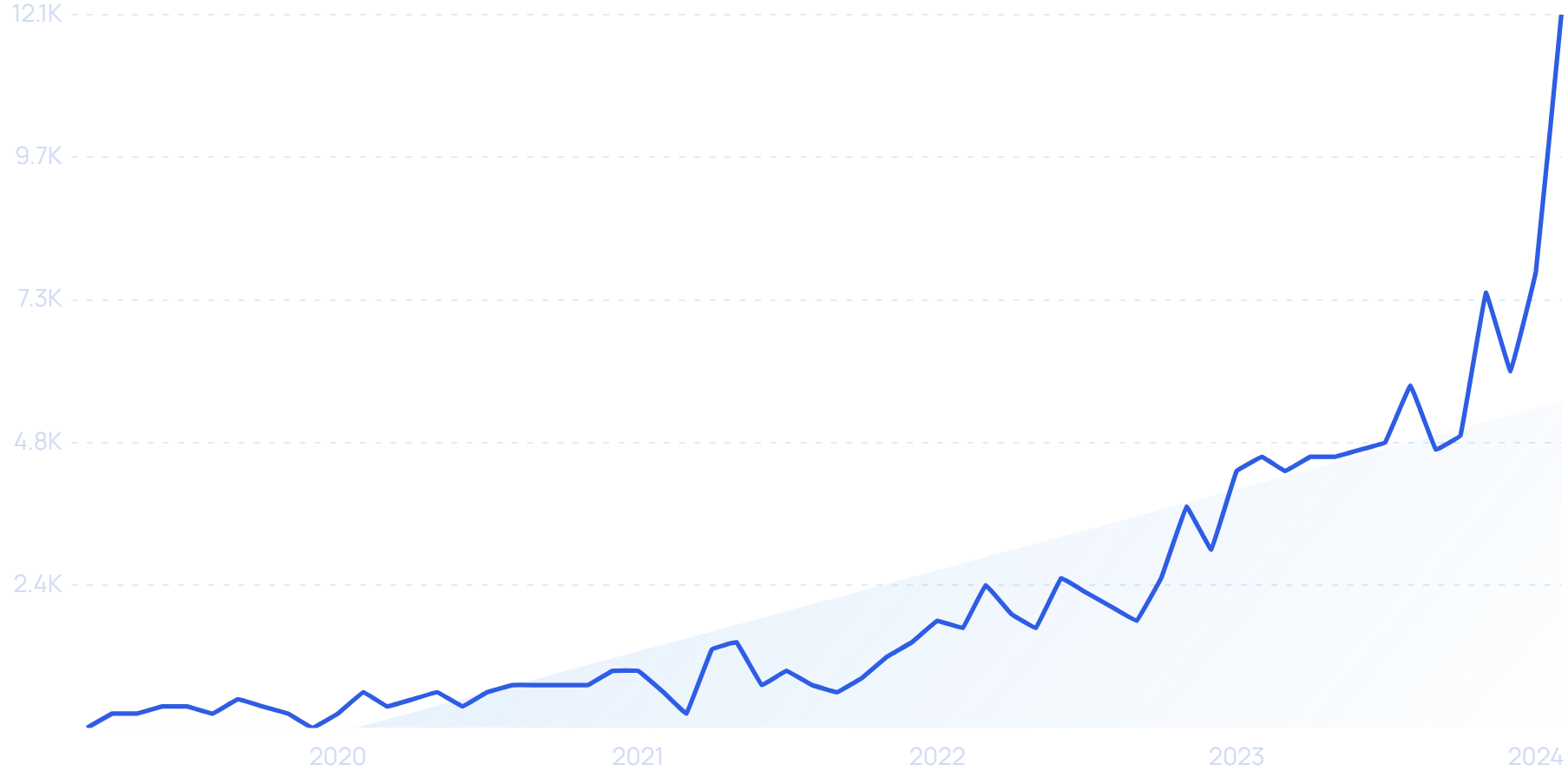

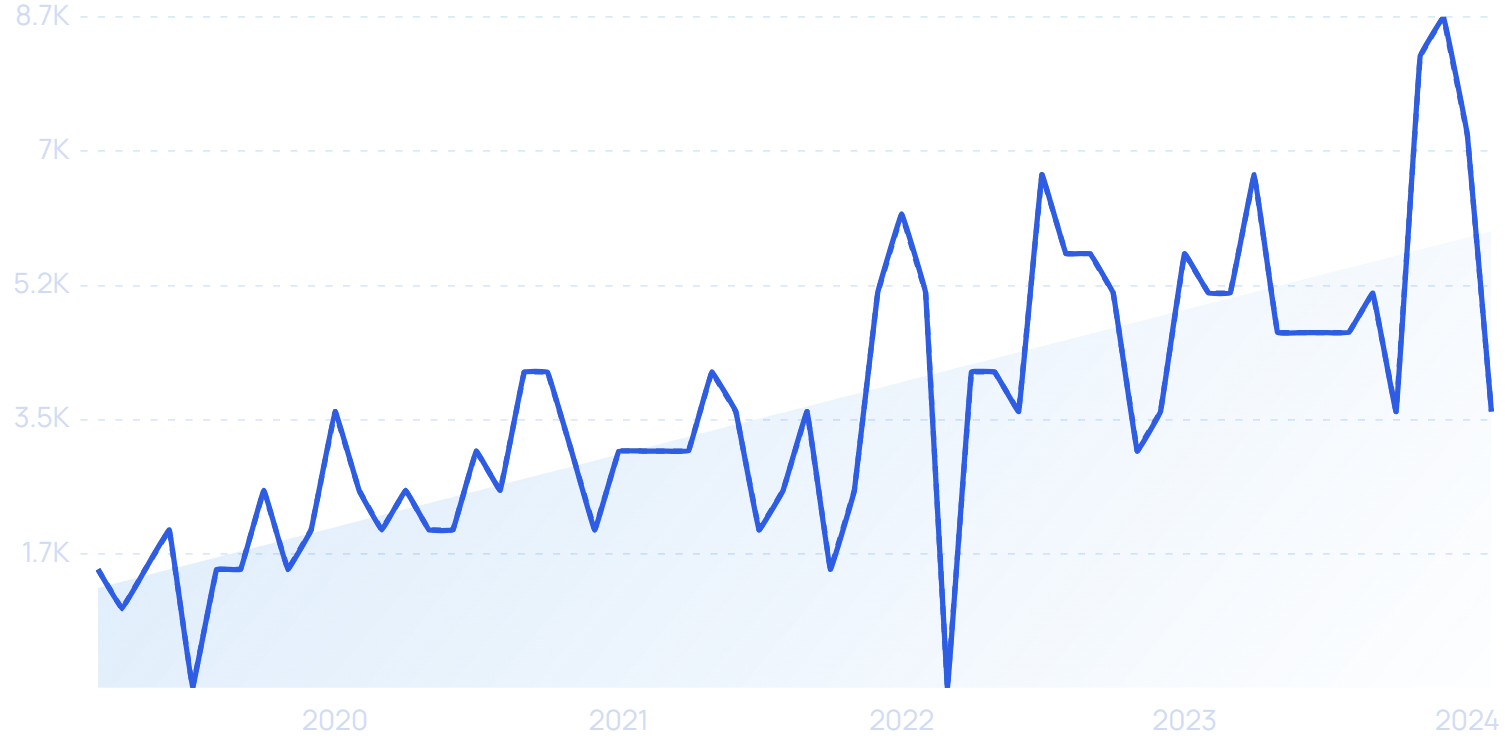

Search volume for “retail media network” has grown more than 2,000% in the past five years.

Spending on retail media advertisements has doubled over the last two years, and the market, as a whole, could be worth as much as $85 billion by 2026.

Large CPG retailers like Walmart, Target, and Amazon have long been selling advertising space on their apps and websites. But a number of smaller brands are now entering the market.

The number of companies investing in retail media networks has grown quickly over the past four years.

And they’re reaping the benefits.

Retailers can realize a profit margin of up to 90% on this type of advertising.

Revenue from Walmart’s retail media platform is predicted to reach $4 billion by the end of 2024, nearly doubling since 2021.

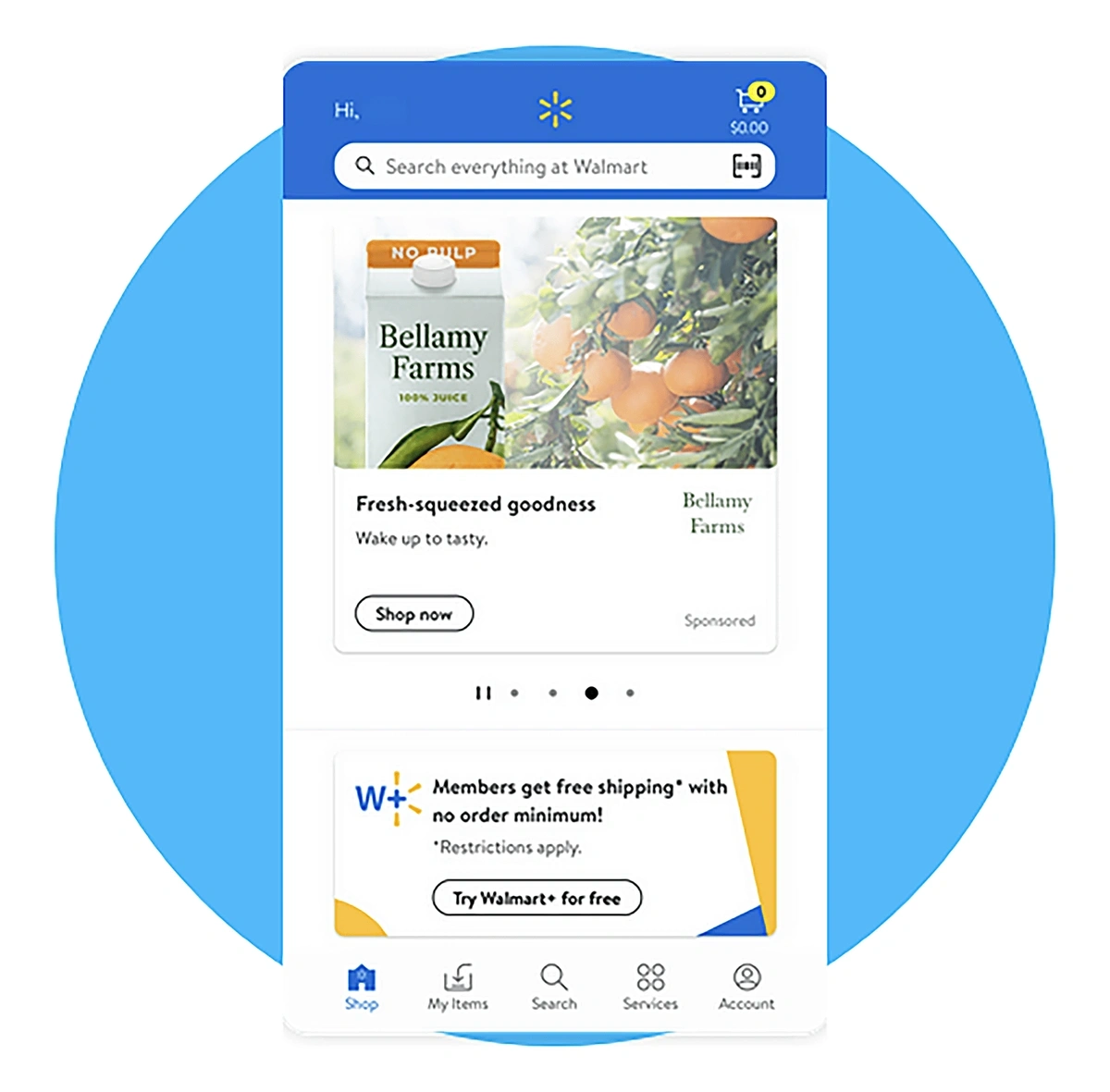

An example of retail media advertising on Walmart’s app.

Walmart is also considering adding in-store retail media advertising opportunities.

They’ve begun testing sampling stations, carts with QR code advertising, and radio ads playing through the Walmart Radio Network.

Amazon, another giant in retail media advertising, brought in $11.6 billion in retail media revenue in Q4 of 2023.

According to CPG marketers, the future looks bright for retail media ads.

More than half say that retail media offers unique advertising opportunities and more than half also say this type of advertising will become more important to their brands in the future.

Conclusion

That wraps up our overview of the CPG market and the trends expected to impact the space in the months to come.

The CPG market is poised for continued growth and innovation. The rise of DTC brands and digital advertising across platforms show that consumers are looking for a personalized experience.

Certain segments like plant-based foods, luxury pet care items, and health and wellness products are driving growth right now. But that could change. As consumers search out private-label products and pay more attention to sustainability measures, CPG companies will need to be quick to adapt.

With a customer-centric approach and a digital-first attitude, CPG brands can thrive in the ever-evolving market.

H/T Alison Zeller (author)

Reply